A new policy of the Central Bank of Nigeria on agent banking may push about 40 per cent Point-of-Sale operators out of business.

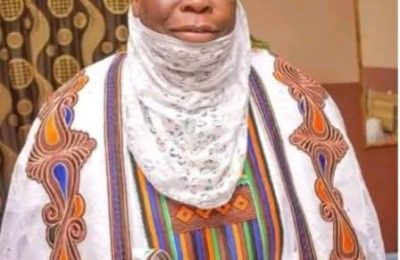

The National President of the Association of Mobile Money and Bank Agents of Nigeria, Fasasi Sharafadeen, told newsmen that the recently released guidelines by the apex bank could cripple small-scale businesses and threaten the country’s financial inclusion efforts.

The CBN released new operational guidelines for agent banking, capping the daily cumulative transactions per PoS agent at N1.2m.

Under the new framework, all agent banking transactions must be conducted through a dedicated account or wallet maintained by the principal financial institution to ensure transparency and better oversight.

The CBN warned that any agent found using non-designated accounts for operations would be in violation of the regulation and would face sanctions.

Agents involved in misconduct or fraud will be blacklisted or have their agreements terminated.

The framework further limits individual customer transactions to N100,000 daily, while agent devices must be geo-fenced to prevent unauthorised mobile use.

The CBN announced that implementation of the new agent location and exclusivity rules would begin on April 1, 2026.

According to Sharafadeen, one of the most worrying aspects of the policy is the introduction of exclusivity, which restricts agents to operate under only one principal or service provider.

He explained that this move would not only reduce the income of PoS agents but also drive many out of business due to the loss of flexibility and customer trust that currently defines agency banking operations.

“About 40 per cent of PoS operators will be out of business,” he said. “Today, there are over 30 million PoS terminals in circulation, and about two million active agents. Many of these agents operate multiple terminals from different service providers to ensure efficiency and customer satisfaction. The new exclusivity rule will destroy that balance.”

He added that PoS operators usually relied on multiple platforms to ensure steady transactions when one network fails.

“Some agents choose a particular provider because of incentives like free bank transfers, while they use another provider that is faster in withdrawals,” he explained. “This mix guarantees customer experience because even when one service is down, they can still serve their customers through another provider.”